Last month, Kuaishou, the short video-sharing app leader in China, that is known as a popular alternative to TikTok has just released its E-Commerce Value Report of 2022.

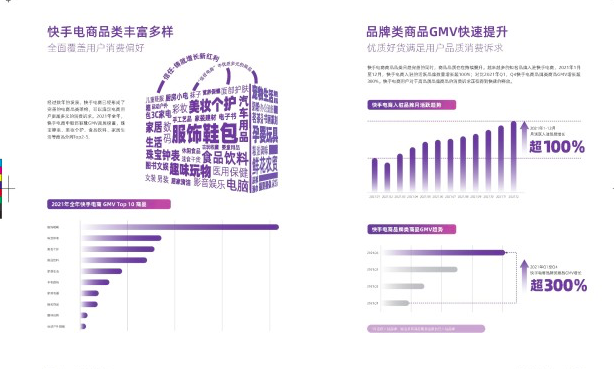

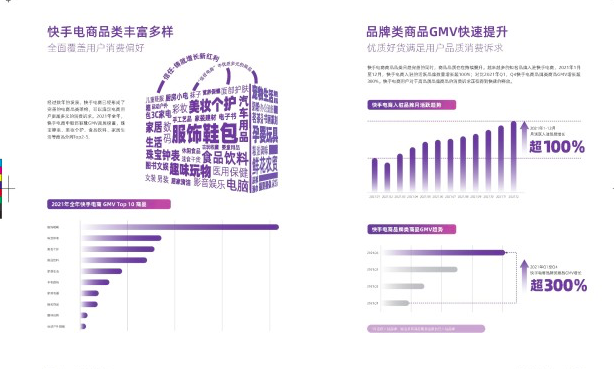

So far, its e-commerce has maintained a very high growth trend. In the whole year of 2021, the total trading volume of Kwaishou e-commerce reached RMB 680 billion yuan, an increase of 78.4%!

Some key data from this year:

Q1 of 2022, the number of daily active users of Kwaishou reached 346million and the number of monthly active users reached 598million, both of which reached a record high. With the enhancement of users' social trust, the diversification of content supply and the continuous iteration of technical models, the total traffic has achieved a high-speed growth of 50% year-on-year, which also laid the foundation for the steady growth of many of its business segments.

In terms of e-commerce business, the data showed that in Q1 2022, Kwai e-commerce GMV increased by 47.7% year-on-year, reaching 175.1 billion yuan. With the promotion of self construction of e-commerce ecosystem, the contribution of Kwaishou store to the platform GMV has reached more than 99%.

At the same time, the number of Kwaishou's monthly active businesses increased by double-digit percentage points year-on-year, and the penetration rate of platform live broadcast e-commerce also maintained an increase.

Online Marketing Services:

In 2021, the revenue in this area reached RMB 42.7 billion yuan, an increase of 95.2% year-on-year. Among them, the revenue from brand advertising was more impressive, with a year-on-year increase of more than 150%.

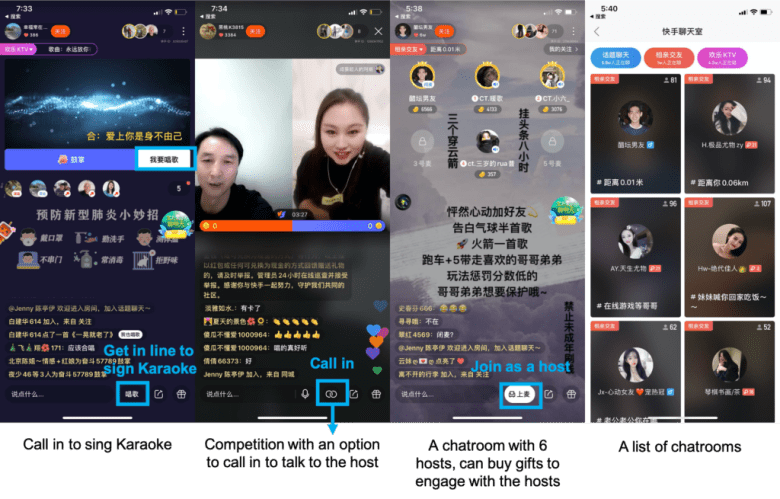

Live Broadcasting:

From Q1 to Q4 in 2021, the monthly per capita consumption of Kwaishou e-commerce users continued to grow, with an increase of nearly 40%. Among them, the higher consumption users with annual consumption of more than RMB 5000 yuan account for 12.9%, which is equivalent to ONE high consumption user in every Eight Kwaishou e-commerce users.

E-Commerce as the only Channel to maintain growth in 2021 on FMCG development

A few days ago, the third-party organization Bain and the Kaidu consumer index released the 2022 China shopper report. The report shows that the development trend of FMCG in 2021 continued until the beginning of 2022. Under the influence of the uncertainty caused by the epidemic, consumers became more cautious and price sensitive, and turbulence will become the new normal.

Research shows thate-commerce has become the only channel to maintain growth in 2021,with the growth rate dropping to 15% from about 30% in previous years. E-commerce platforms are also gradually differentiated. Among them, live e-commerce platforms represented by Tiktok and Kwaishou and Pinduoduo are winning the favor of more and more consumers.

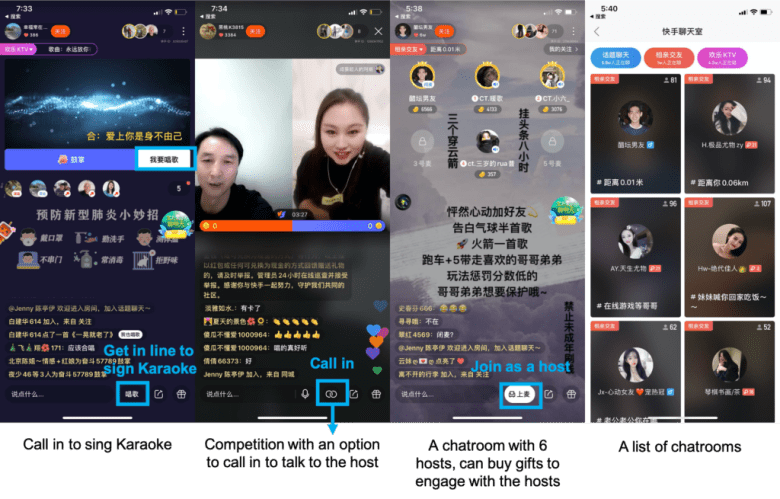

Among one of the most influential social media giants, here is its milestones to explain what it is and its business model

Kwaishou E-commerce Platform has carried out cross-border import business since last year, and began to attract merchants for businesses selling cross-border goods. Businesses can share goods in Kwaishou import stores in the form of short videos and live broadcasts, so as to bring users high-quality goods and service experience. Merchants who want to operate cross-border imported goods on the platform need to complete the store opening process through the Kwaishou CBEC Investment and Settlement. Note that "merchants" do not include anchors promoting cross-border goods links on third-party platforms.

Below explains the basic entry qualifications for merchants to sell CBEC goods on its platform

1、Entry process of Kwai import store

At this stage, only the platform invitation system is supported to settle in. You may contact Kuaishou through email to introduce your company, business and products. The platform will decide whether you can join in according to the actual situation, including but not limited to: brand influence, company business status, service level and other factors after comprehensive evaluation.

2、Kwaishou Import Store Recruiting Requirement:

Basic requirements:

(1) The settled business entity must have overseas or registered company entities in Hong Kong, Macao and Taiwan, China, and have overseas retail or trade qualifications;

(2) The settled merchants need to have the subject of joint and several liability in Chinese Mainland, that is, the domestic agent;

(3) The settled business entity needs to have a corporate bank account overseas or in Hong Kong, Macao and Taiwan.

Preferred ones:

(1) Give priority to recruiting overseas brands and brand agents in Hong Kong, Macao and Taiwan, as well as well-known brands that have NOT enteredthe Chinese market;

(2) Priority should be given to recruiting entities with its own e-commerce teams and cross-border e-commerce operation experience.

As social media giants all choose go into the CBEC business with their own platform, it is clearly they all adopt “Invitation Only“ rules, by complete taking control of their business partners. The rules maybe implicit, but it is always better to start at the early stage when the CBEC platforms are relatively young and the audience is mature and used to e-commerce on social media.

Invitation Only means presentation on the initial contact with responsible parties is vital to decide whether your brand and products can be accepted. Especially for unknown brands in China, this first impression makes the content on social media potential, have to be carefully packaged.

WKI Probe Plan can be the package of your initial presentation to the platforms.

It is worth highlighting that new comers to the China market are more welcomed. It won’t cost much to get in contact with staff who in charge of the invitation on platforms, not only on Kuaishou.

Contact us to find out more:

So far, its e-commerce has maintained a very high growth trend. In the whole year of 2021, the total trading volume of Kwaishou e-commerce reached RMB 680 billion yuan, an increase of 78.4%!

Some key data from this year:

Q1 of 2022, the number of daily active users of Kwaishou reached 346million and the number of monthly active users reached 598million, both of which reached a record high. With the enhancement of users' social trust, the diversification of content supply and the continuous iteration of technical models, the total traffic has achieved a high-speed growth of 50% year-on-year, which also laid the foundation for the steady growth of many of its business segments.

In terms of e-commerce business, the data showed that in Q1 2022, Kwai e-commerce GMV increased by 47.7% year-on-year, reaching 175.1 billion yuan. With the promotion of self construction of e-commerce ecosystem, the contribution of Kwaishou store to the platform GMV has reached more than 99%.

At the same time, the number of Kwaishou's monthly active businesses increased by double-digit percentage points year-on-year, and the penetration rate of platform live broadcast e-commerce also maintained an increase.

Online Marketing Services:

In 2021, the revenue in this area reached RMB 42.7 billion yuan, an increase of 95.2% year-on-year. Among them, the revenue from brand advertising was more impressive, with a year-on-year increase of more than 150%.

Live Broadcasting:

From Q1 to Q4 in 2021, the monthly per capita consumption of Kwaishou e-commerce users continued to grow, with an increase of nearly 40%. Among them, the higher consumption users with annual consumption of more than RMB 5000 yuan account for 12.9%, which is equivalent to ONE high consumption user in every Eight Kwaishou e-commerce users.

E-Commerce as the only Channel to maintain growth in 2021 on FMCG development

A few days ago, the third-party organization Bain and the Kaidu consumer index released the 2022 China shopper report. The report shows that the development trend of FMCG in 2021 continued until the beginning of 2022. Under the influence of the uncertainty caused by the epidemic, consumers became more cautious and price sensitive, and turbulence will become the new normal.

Research shows thate-commerce has become the only channel to maintain growth in 2021,with the growth rate dropping to 15% from about 30% in previous years. E-commerce platforms are also gradually differentiated. Among them, live e-commerce platforms represented by Tiktok and Kwaishou and Pinduoduo are winning the favor of more and more consumers.

Among one of the most influential social media giants, here is its milestones to explain what it is and its business model

Kwaishou E-commerce Platform has carried out cross-border import business since last year, and began to attract merchants for businesses selling cross-border goods. Businesses can share goods in Kwaishou import stores in the form of short videos and live broadcasts, so as to bring users high-quality goods and service experience. Merchants who want to operate cross-border imported goods on the platform need to complete the store opening process through the Kwaishou CBEC Investment and Settlement. Note that "merchants" do not include anchors promoting cross-border goods links on third-party platforms.

Below explains the basic entry qualifications for merchants to sell CBEC goods on its platform

1、Entry process of Kwai import store

At this stage, only the platform invitation system is supported to settle in. You may contact Kuaishou through email to introduce your company, business and products. The platform will decide whether you can join in according to the actual situation, including but not limited to: brand influence, company business status, service level and other factors after comprehensive evaluation.

2、Kwaishou Import Store Recruiting Requirement:

Basic requirements:

(1) The settled business entity must have overseas or registered company entities in Hong Kong, Macao and Taiwan, China, and have overseas retail or trade qualifications;

(2) The settled merchants need to have the subject of joint and several liability in Chinese Mainland, that is, the domestic agent;

(3) The settled business entity needs to have a corporate bank account overseas or in Hong Kong, Macao and Taiwan.

Preferred ones:

(1) Give priority to recruiting overseas brands and brand agents in Hong Kong, Macao and Taiwan, as well as well-known brands that have NOT enteredthe Chinese market;

(2) Priority should be given to recruiting entities with its own e-commerce teams and cross-border e-commerce operation experience.

As social media giants all choose go into the CBEC business with their own platform, it is clearly they all adopt “Invitation Only“ rules, by complete taking control of their business partners. The rules maybe implicit, but it is always better to start at the early stage when the CBEC platforms are relatively young and the audience is mature and used to e-commerce on social media.

Invitation Only means presentation on the initial contact with responsible parties is vital to decide whether your brand and products can be accepted. Especially for unknown brands in China, this first impression makes the content on social media potential, have to be carefully packaged.

WKI Probe Plan can be the package of your initial presentation to the platforms.

It is worth highlighting that new comers to the China market are more welcomed. It won’t cost much to get in contact with staff who in charge of the invitation on platforms, not only on Kuaishou.

Contact us to find out more: