NetEase Kaola was founded by Netease in 2015 as the very first to establish CBEC platform in China. It was once a comprehensive e-commerce platform under the company, mainly focusing on B2C cross-border import e-commerce business. In the cross-border e-commerce field, whether it is logistics management or supply chain expansion, NetEase Kaola has always played a pioneer role.

Just a few years later, its place of the absolute market leader has shifted.

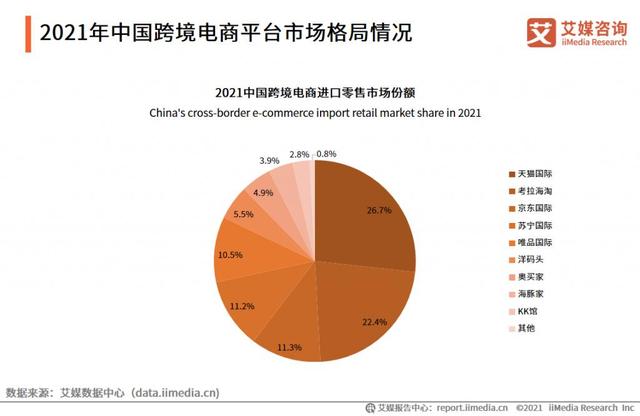

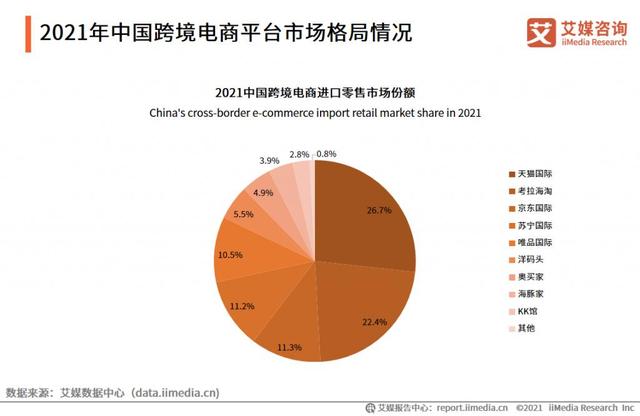

As the following chart explained the CBEC market share of China in 2021.

In 2019, the owner of Tmall Global, Alibaba Group bought NetEase Kaola, for US $2 billion, starting to take over the top one place in the market. So far, the two combined still takes up a lion’s share of the market.

JD International is just behind the top two, and it has been strategically building up its CBEC empire by constantly making the news with its national pavilions plans and its collaboration with other social media such as RED as we discussed before in WKI’s previous posts.

The next few players in CBEC have very close places, but in 2022 and the coming 2023, the outcome of the CBEC market share may shift significantly with strong new players such as Tik Tok and Kuaishou entering the CBEC business. But that is another story. In this article, let’s have a close look of how and why Kaola starts as the first comer and settled for the market buyout while slowing giving up its market share.

Since its establishment, with the help of NetEase Group's rich product resources, flow resources and capital strength, NetEase Kaola has achieved rapid development and established competitive advantages such as self operated mode, independent pricing, global distribution and large-scale bonded warehouse.

At that time, NetEase Kaola has a high market share, but its profitability is insufficient. The self operated direct purchase business model of NetEase Kaola requires a high input cost, and its own turnover rate is not high, which reduces the inventory turnover rate and thus increases the storage cost. At the same time, domestic Alibaba, JD.com and Pinduoduo occupy most of the market shares of domestic e-commerce. Although NetEase Kaola has achieved the first place in the cross-border field, the gap in total transaction volume is still quite obvious.

Although its profitability is not strong enough, its high net worth consumer group, mature self-operation mode and rich overseas partner resources are incomparable to other players in the same industry.

One year after joining Alibaba, Liu Peng, then CEO of Kaola Haigou, announced that Kaola Haigou's strategy was upgraded to member e-commerce, focusing the target user group on the 300 million new middle-class in China, and clearly stated that "Kaola does not need to become the second Tmall Global".

Recently, Kaola Haigou Luxury Channel has also been officially launched, and the intention of serving users within the "five rings" of Beijing is more obvious.

It is reported that its luxury channel includes light luxury fashionable bags, heavy luxury famous bags, clothing accessories, fashionable shoes, jewelry watches and other categories, covering more than 200 brands and tens of thousands of goods.

The purpose of narrowing down the focused consumer groups step by step is not only to "make way" for Tmall Global, but also to find the most suitable development path within the Alibaba system.

Old time Mitao and today's Miya have been calm in the cross-border circle. Under the cross-border impact of Tiktok Global Shopping, Pinduoduo International and Taobao Global, Dewu and Kwaishou, the previous cross-border leaders of Yunji, Onion and Suning International are not as fierce as before as you can find in the chart at the beginning of this article.

The development of the platform is changing day by day, and the leader of that year may be drag behind in just a few years. The gap of Chinese consumers preference between imported goods and domestic brands is narrowing. It is particularly important to choose which platforms to invest and cooperate with. When overseas brands buy admission tickets, they also need to carefully analyze the data of the platform, rather than blindly following the crowd. Sometimes big traffic pays off, sometimes with the right angle, even niche products can prevail and go viral in the market.

Also with the market getting more and more mature and sophisticated, each platform is figuring their path to position to the right segment for sustainable development. Kaola may have claimed itself to be focusing only on high end, yet it still will face competition from the traditional end of luxury goods. Its future is still unclear data-wise.

That is why you need WKI to be your navigator for your future plan in China. Contact us to find out more.

Just a few years later, its place of the absolute market leader has shifted.

As the following chart explained the CBEC market share of China in 2021.

In 2019, the owner of Tmall Global, Alibaba Group bought NetEase Kaola, for US $2 billion, starting to take over the top one place in the market. So far, the two combined still takes up a lion’s share of the market.

JD International is just behind the top two, and it has been strategically building up its CBEC empire by constantly making the news with its national pavilions plans and its collaboration with other social media such as RED as we discussed before in WKI’s previous posts.

The next few players in CBEC have very close places, but in 2022 and the coming 2023, the outcome of the CBEC market share may shift significantly with strong new players such as Tik Tok and Kuaishou entering the CBEC business. But that is another story. In this article, let’s have a close look of how and why Kaola starts as the first comer and settled for the market buyout while slowing giving up its market share.

Since its establishment, with the help of NetEase Group's rich product resources, flow resources and capital strength, NetEase Kaola has achieved rapid development and established competitive advantages such as self operated mode, independent pricing, global distribution and large-scale bonded warehouse.

At that time, NetEase Kaola has a high market share, but its profitability is insufficient. The self operated direct purchase business model of NetEase Kaola requires a high input cost, and its own turnover rate is not high, which reduces the inventory turnover rate and thus increases the storage cost. At the same time, domestic Alibaba, JD.com and Pinduoduo occupy most of the market shares of domestic e-commerce. Although NetEase Kaola has achieved the first place in the cross-border field, the gap in total transaction volume is still quite obvious.

Although its profitability is not strong enough, its high net worth consumer group, mature self-operation mode and rich overseas partner resources are incomparable to other players in the same industry.

One year after joining Alibaba, Liu Peng, then CEO of Kaola Haigou, announced that Kaola Haigou's strategy was upgraded to member e-commerce, focusing the target user group on the 300 million new middle-class in China, and clearly stated that "Kaola does not need to become the second Tmall Global".

Recently, Kaola Haigou Luxury Channel has also been officially launched, and the intention of serving users within the "five rings" of Beijing is more obvious.

It is reported that its luxury channel includes light luxury fashionable bags, heavy luxury famous bags, clothing accessories, fashionable shoes, jewelry watches and other categories, covering more than 200 brands and tens of thousands of goods.

The purpose of narrowing down the focused consumer groups step by step is not only to "make way" for Tmall Global, but also to find the most suitable development path within the Alibaba system.

Old time Mitao and today's Miya have been calm in the cross-border circle. Under the cross-border impact of Tiktok Global Shopping, Pinduoduo International and Taobao Global, Dewu and Kwaishou, the previous cross-border leaders of Yunji, Onion and Suning International are not as fierce as before as you can find in the chart at the beginning of this article.

The development of the platform is changing day by day, and the leader of that year may be drag behind in just a few years. The gap of Chinese consumers preference between imported goods and domestic brands is narrowing. It is particularly important to choose which platforms to invest and cooperate with. When overseas brands buy admission tickets, they also need to carefully analyze the data of the platform, rather than blindly following the crowd. Sometimes big traffic pays off, sometimes with the right angle, even niche products can prevail and go viral in the market.

Also with the market getting more and more mature and sophisticated, each platform is figuring their path to position to the right segment for sustainable development. Kaola may have claimed itself to be focusing only on high end, yet it still will face competition from the traditional end of luxury goods. Its future is still unclear data-wise.

That is why you need WKI to be your navigator for your future plan in China. Contact us to find out more.